2023/2024 Maximum Levy Rate

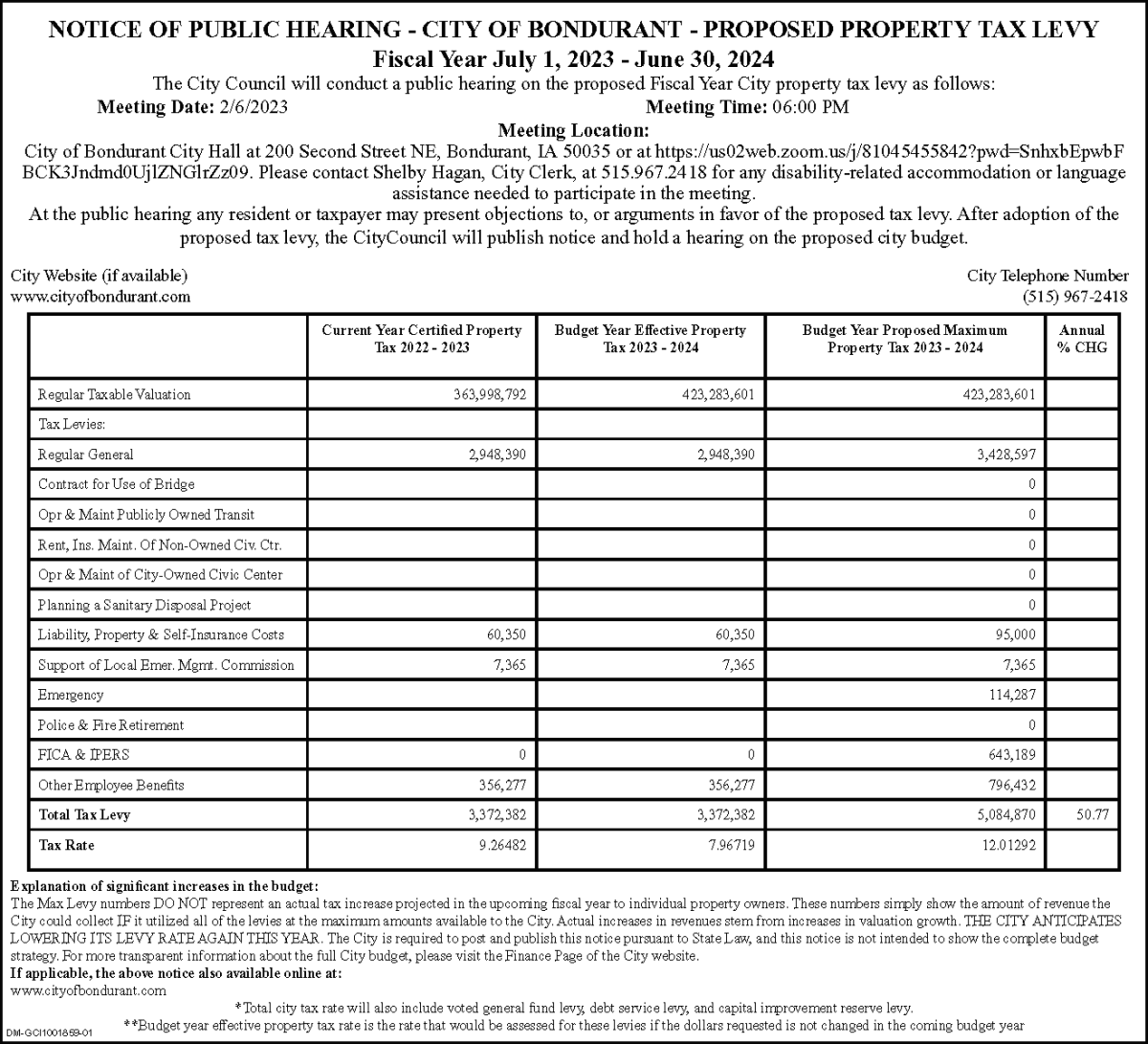

The City of Bondurant conducted a public hearing on the “Proposed Fiscal Year 2023/2024 City Property Tax Levy” on February 6, 2023, at 6:00 p.m. both virtually or in person at City Hall, 200 Second Street NE, Bondurant.

Access the Max Levy Rate Resolution approved by City Council.

The City is required by State Law to publish this notice in advance of the final proposed budget hearing notice. The rate notice prescribed by the State can be confusing, referencing this as a hearing on the "Proposed Property Tax Levy" as this is neither the property tax levy the City is proposing nor the full levy rate. This hearing is on the maximum amount of revenue the City can collect from certain tax levies. For the City of Bondurant, the maximum amount of revenue that could potentially be collected from the levies included in this hearing notice IF the City chose to utilize each of the levies fully, is $5,084,870, significantly higher than the FY23 number of $3,372,382. (Please note the City does not intend to use all of these levies, nor does it intend to use the levies in the amount listed in the notice.) The amount of revenue that could be collected is greater than the prior fiscal year based on the City's valuation growth. This does not mean an increase in individual homeowners’ property taxes, and it does not mean that the City is proposing to collect all of these revenues. The City is proposing to lower its levy rate for the 17th year in a row. The increase in revenue shown in the notice is driven primarily by new construction and significant new industrial and commercial valuation. Taxable growth is also driven by the increase in the rollback percentage from 54.1302% in FY23 to 56.4919% in FY24, meaning that a greater percentage of the valuation of a residential property is taxable. A factor contributing to the increase in residential valuation is the action taken by the State Legislature in 2021 with the passage of HF418. That bill combined Residential and Multi residential Property Classes. The Legislative Services Agency confirmed that combining the property classes increased the rollback for residential properties; thereby increasing the amount of valuation on single-family properties subject to taxation.

The final property tax levy rate in Bondurant will again be reduced by the use of Local Option Sales and Services Tax, which is not reflected in the Max Levy information. The City has used LOSST to reduce property tax levy rates since FY21, after Bondurant residents overwhelmingly approved a sales tax measure. (The hearing on the full budget and final proposed levy rate will be held in March.) The City is required by State Law to publish the “Max Levy” notice in advance of the final proposed budget hearing notice.

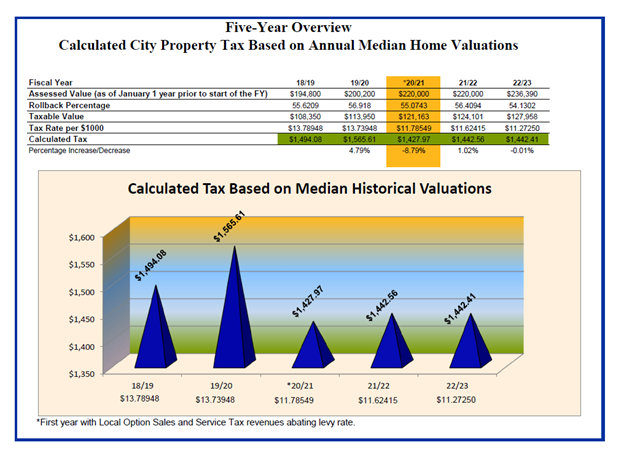

Below is a five-year overview to better illustrate what an average homeowner has historically paid in City property taxes. The calculation is based on a home of median value.

If you have questions about the City’s budget, budget process, or financial information, please do not hesitate to contact Marketa Oliver, City Administrator or Jené Jess, Finance and Employee Services Director, at 515.967.2418.