Did you receive your new property tax evaluation from Polk County?

The Polk County Assessor mailed out 2023 Assessment notices on March 31.

Posted on: April 5, 2023 - 2:50pm

The Polk County Assessor is independent of the City of Bondurant and the Iowa Department of Revenue. The Polk County Assessor’s Office uses data from the property sale to determine the assessments. The market has seen a lot of appreciation; properties were, on average, selling for about 25% more than their 2021 assessments. Property taxes will NOT be increasing by this percentage due to revaluation or reassessment; residential rollback limits the taxable value to 3% statewide.

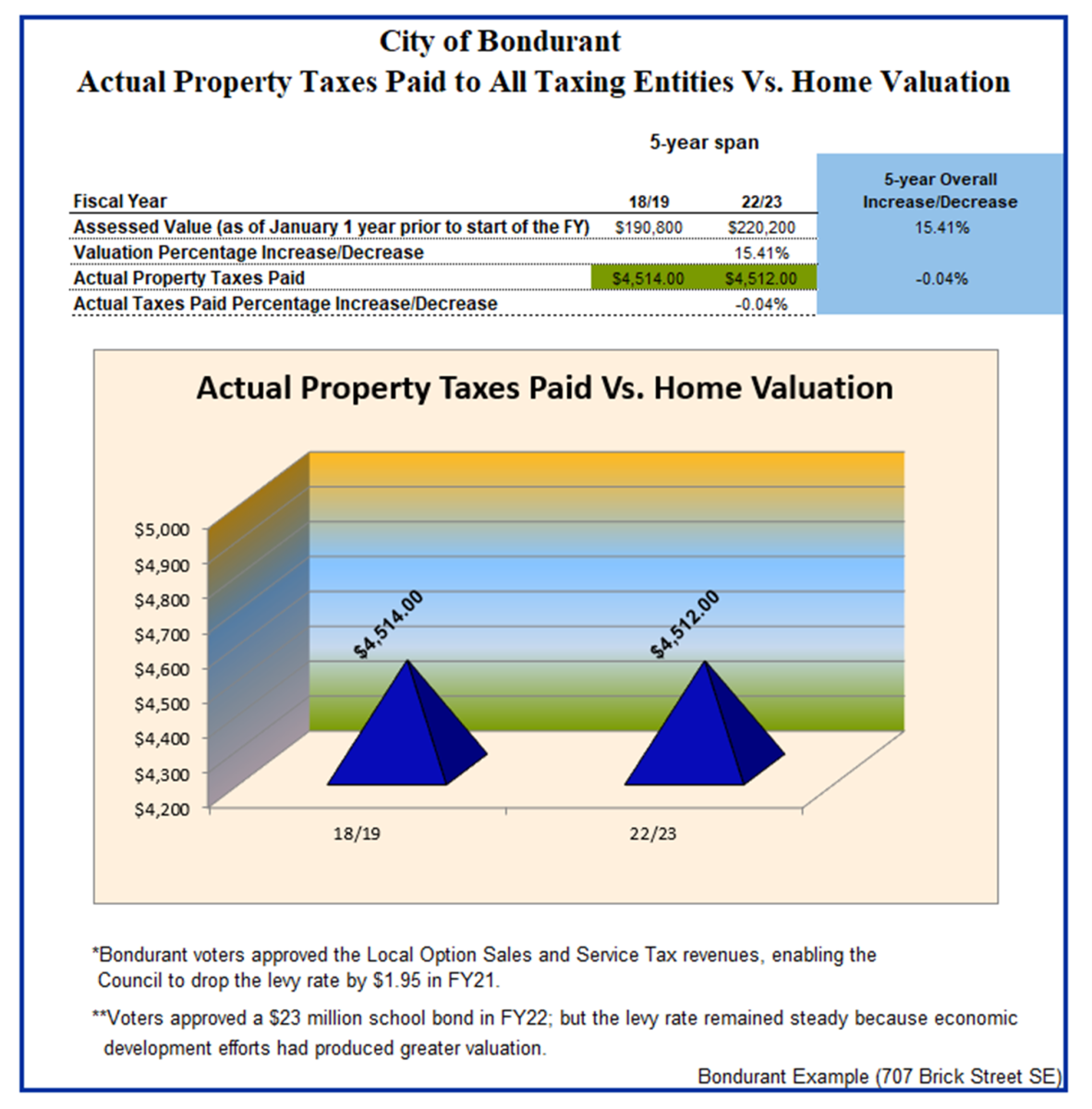

Please note that an increase in your property assessment does not lead to a direct and proportionate increase in property taxes. For example, in Bondurant, a house of median valuation has increased by more than 15% over the past five years and pays $2 less in property taxes to all taxing entities than it did five years ago. (See graph below.) While the property is assessed at a higher value, the actual taxes paid are lower because the City and the School District have lowered rates. This has been made possible due to ambitious economic development efforts.

The taxes based on your 2023 assessment will be payable in September 2024 and March 2025. If you feel the assessment of your home is wrong, you may protest via the Polk County Board of Review between April 2 - May 1 at www.assess.co.polk.ia.us

Eight other entities collect revenue from those who pay property taxes in Bondurant. Following is the breakdown by percentage:

• 43.79% - Bondurant-Farrar Community School District

• 28.57% - City of Bondurant

• 17.16% - Polk County

• 10.48% - State of Iowa, Broadlawns Medical Center, DMACC, DART, Polk County Assessor, and Polk County Ag Extension

For additional information on the assessment process, please refer back to the information posted earlier on the City’s website at: https://www.cityofbondurant.com/home/news/role-your-assessed-value-plays-determining-property-taxes.