City Council Adopts FY24 Budget and Lowers Levy Rate for 17th Consecutive Year

On March 20th, the City Council adopted the Fiscal Year 2023-2024 budget and a Capital Improvements Plan for the upcoming five years. The budget provides the financial plan for all City funds and activities for the fiscal year beginning July 1, 2023, and ending June 30, 2024.

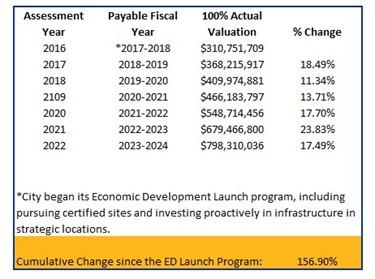

The tax levy rate is $11.26219, a $0.01031 reduction from the current rate of $11.27250 per thousand dollars of taxable valuation and the 17th consecutive year for a reduction. The continued decrease is possible through the voter-approved Local Option Sales and Services Tax (LOSST) and execution of the financial and economic development policies adopted by the City Council that has led to significant valuation increases. Below is a table showing the City’s valuation growth, a direct result of decisions made by the City’s elected leadership. During FY18, the City began an Economic Development Launch program, focusing on site certification as an economic development tool and strategically investing in infrastructure in targeted locations where development was likely imminent. The results have been hugely beneficial, providing a growing commercial and industrial valuation foundation to support the community’s needs.

Expenditures and Revenues

Operating expenditures align with available revenues through the lens of the City Council’s strategic plans, financial policies, and legislative directives. Expenditures for FY23 year-end are estimated to be $25,870,648, and projected expenses for FY24 are $40,789,939. Please note that is NOT a structural budget deficit. There are more expenditures than revenues in FY24 due to multi-year capital projects, for which the revenue was received in a prior year, and the fund balance is being drawn over multiple years as the project is completed. Capital projects continue to be a significant driver of the budget. Capital Projects are 37.71% of the year-end estimate and 53.59% of the proposed budget. Revenues are proposed to be $20,547,252 and estimated at $25,312,654 for year end. Capital projects are supported by several different funding sources, including grants, bonds, and charges for services (which arise from payments to connect into water/sewer systems). Bonds are repaid using the property tax debt service levy, Tax Increment Financing, Charges for Service (for utility projects), and transfers from other funds such as Road Use Taxes and the Local Option Sales and Services Tax (LOSST). Bondurant voters approved LOSST in August 2019, and it has been an essential source to fund capital projects and reduce the property tax levy.

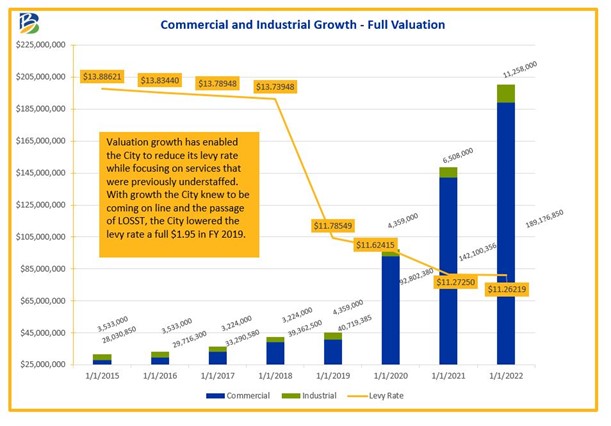

The goal of the City’s capital investments is to maintain good infrastructure as well as accommodate commercial and industrial growth. The City’s commercial and industrial growth over the past few years has enabled the Council to achieve the ongoing goal of property tax reduction while expanding services to meet the needs of a growing community. This graph shows the connection between the commercial and industrial growth and the City’s levy rate.

Recent Accomplishments

Throughout the past fiscal year and to date in the current fiscal year to date, the City has continued to achieve goals established and prioritized by the City Council. Accomplishments include:

- Completed expansion and renovation of the Bondurant Community Library;

- Launched Sunday hours for the Library;

- Added a Firefighter/EMT/Paramedic position;

- Outfitted the Bondurant Emergency Services facility with a generator, primarily funded through a grant from FEMA;

- Partnered with Emergency Services Consulting group to create a Strategic Plan for Bondurant Emergency Services;

- Secured $29,900 in grant funding to continue an aggressive canopy expansion program, planting 124 trees, 60 of which were street trees and 64 at the Bondurant Recreational Sports Complex;

- Secured funding for and built a dog park, naming it Pawtocka;

- Substantially completed construction of the Highway 65 Underpass;

- Collaborated with the Bondurant Community Foundation to achieve Iowa Great Place redesignation;

- Finalized Building Bondurant Comprehensive Plan;

- Adopted the Central District Stormwater Improvements Master Plan;

- Secured more than $2.5 million in outside funding/contributions for various City projects and programs (during FY22 and year-to-date in FY223);

- Completed two additional major economic development projects (Project Omega and Commerce Crossings);

- Facilitated another Certified Site designation for industrial property and initiated the planning process on three additional sites;

- Promoted civic partnerships (continued collaboration with the School District, Community Foundation, BDI, the Chamber of Commerce, and the Men’s Club) and hosted events coordination meetings among civic organizations;

- Purchased land for the Civic Campus project and began master planning;

- Finalized construction of the NE Stormsewer Project;

- Collaborated with multiple property owners to annex nearly 1,000 acres into Bondurant;

- Purchased ground for a new water tower;

- Pursued a feasibility study for redevelopment of grain silos downtown;

- Created an Economic Development Coordinator position;

- Began major construction project in Eagle Park;

- Developed a Compensation Philosophy and Policy;

- Completed Ditch 2 Stream Stabilization Project, securing a $285,000 State grant to offset costs of the project;

- Added a Public Works Operations Coordinator position to serve as a working supervisor and support the Public Works Director;

- Initiated the Cleargov budget Transparency platform;

- Launched water planning efforts, evaluating the feasibility of producing and treating water while also analyzing the advantages and disadvantages of joining Central Iowa Water Works; and

- Earned multiple awards for innovative programs and transparency, including:

- 2022 Iowa Community of Character from the Ray Center;

- FY23 and FY22 GFOA Distinguished Budget Presentation Award;

- 2022 Program Excellence Award in Strategic Governance from the International City/County Management Association for the Strategic Continuous Operational Redesign and Evaluation (SCORE) Program;

- 2022 Program Excellence Award in Community Sustainability from the International City/County Management Association for the Economic Development Launch Program;

- 2022 Excellence in Economic Development Bronze Award from the International Economic Development Council;

- 22 from 2022 Business People Making a Difference – Tiffany Luing, Economic Development Coordinator, Cityview Business Journal;

- 2022 Iowa Library Association Distinguished Leadership Award – Jill Sanders;

- 2022 Pacesetter Award – Jené Jess and Marketa Oliver, Iowa Public Employers Labor Relations Association;

- 2023 Bondurant Chamber of Commerce Organization of the Year Award - Bondurant Community Library; and

- 2023 Best Development Award (Renovated Civic) from 1,000 Friends of Iowa.

Tax Rate/Residential Rollback

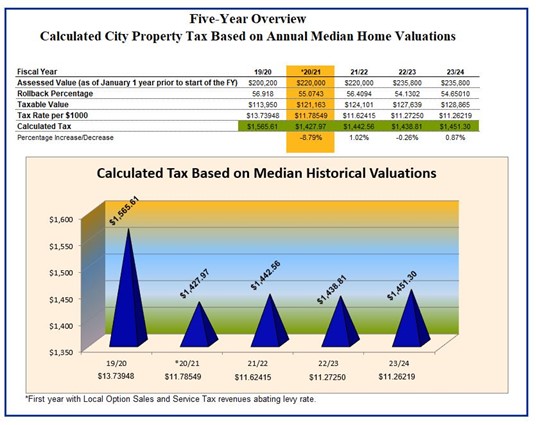

As mentioned, the proposed levy rate is $11.26219 per thousand dollars of taxable valuation. The levy rate is only one factor in determining what a homeowner will pay in property taxes, and the City is only one portion of a homeowner's taxes. In order to calculate what a property owner will pay, the three main factors that go into the calculation are: Assessed Valuation, Rollback, and Levy Rate. Since 1978, residential and agricultural property has been subject to an assessment limitation order known as the "rollback" that limits the annual growth of property values. (All other classes of property were eventually added.) The rollback formula ties residential property growth to that of agricultural property. Based on the action by the State Legislature in 2013, residential and agricultural property are now capped at a 3% aggregate statewide) growth value, whichever is lower between the two classes. Each year, the State of Iowa determines what the rollback is. This year, the residential rollback is 54.65010; 0.5199 higher than last year's rollback rate, meaning slightly more of a property's assessed valuation is taxable.

Considering these factors, under the proposed levy rate, the homeowner with the median-priced home in Bondurant will pay approximately the same in City property taxes next year as they paid this year, at $1,451.30. For approximately $121 per month, the citizens and visitors of Bondurant receive 24-hour law enforcement and Fire protection; emergency medical services; recreational facilities and parks programming; road repair and reconstruction; capital projects upgrading the infrastructure they use every day; and a host of other services and protections. Below is a chart showing a five-year overview of what an individual homeowner would pay in City taxes.

The FY24 budget reflects the City's ongoing priorities of enhancing strong core public safety and public works services. The budget includes operational funding to enhance current staffing levels, which is consistent with the City’s Mission. The proposed budget adds a Fire/EMS Position and a part-time Utility Operations Specialist in the Public Works Department to meet the demand for services and maintenance due to the expansion of the City’s utilities, roads, parks, and trails.

The budget proposal also funds multiple planning and design efforts in the upcoming year, including a water system study completion (and possibly facilities design depending on the outcome of the study), Grant Street S/Central Park Phase 1 design; City Park design; zoning code development; Certified Sites work; and the Bondurant Emergency Services facilities design, as well as finalizing the Master Streets Arterial Plan. Additionally, funding is in the FY23 year-end estimate to develop an Arts, Culture, and Way-finding Master Plan.

Funding is also in the budget for participation in various local and regional efforts, including: contribution to the Des Moines International Terminal project ($17,145 for each of the upcoming four fiscal years), Greater Des Moines Partnership ($10,000), Bravo ($1,500), Convention and Visitors Bureau ($1,500), MPO ($7,365), Mid Iowa Planning Alliance, Bondurant Chamber of Commerce ($1,500), Iowa League of Cities ($3,000), Mid-Iowa Association of Local Governments ($600), EPIC ($5,000), and ICON Water Trails ($8,000). The City also collaborates with other organizations for mutually beneficial purposes and shares staff. For example, the City is a member of the Metro Home Improvement Program, administered by the City of West Des Moines. The program offers home repair and rehabilitation for low-to-moderate income homeowners. The City's investment pays for administration and for the cost of the repairs within the City limits.

A significant portion of the budget remains capital investment. The City achieved a rating upgrade for its General Obligation debt to Aa3 and on Annual Appropriation debt to A1 during FY22. This helps lower interest rates on capital investments that necessitate debt issuance. From FY23 through FY27, the City has more than $97 million in capital investment completed, pending, or planned. In FY23, capital costs are expected to be $12,193,396 and in FY24 at $23,623,493. The capital spending plan reflects council priorities as discussed throughout the year and during facilitated strategic planning sessions. It is important to note that the Capital Improvement Plan (CIP) is a snapshot in time and a foundation to prepare for future action. The CIP, however, does not prevent the City from re-organizing priorities to take advantage of strategic opportunities. The City has previously shown its ability to pivot quickly to leverage available outside funding or to meet unanticipated needs.

A significant portion of the budget remains capital investment. The City also achieved a rating upgrade for its General Obligation debt to Aa3 and on Annual Appropriation debt to A1 during FY22. This helps lower interest rates on capital investments that necessitate debt issuance. From FY23 through FY27, the City has more than $97 million in capital investment completed, pending, or planned. In FY23, capital costs are expected to be $12,193,396 and in FY24 at $23,623,493.

The capital spending plan reflects council priorities as discussed throughout the year and more specifically during facilitated strategic planning sessions held throughout calendar year 2022 and early in 2023. It is important to note that the Capital Improvement Plan (CIP) is a snapshot in time and a foundation to prepare for future action. The CIP, however, does not prevent the City from re-organizing priorities to take advantage of strategic opportunities. The City has previously shown its ability to pivot quickly to leverage available outside funding or to meet unanticipated needs.

If you would like to review the budget in detail, you can access the City’s digital budget book at: https://city-bondurant-ia-budget-book.cleargov.com/9349/introduction/budget-presentation-award. Additionally, if you go to the City’s website at: www.cityofbondurant.com and click the “#LIFECONNECTINGTHEDOTS” banner at the top of the page, you will be taken to an interactive platform where you can learn more about revenues, expenditures, demographics, projects, debt, and department dashboards.