Debt to Finance Capital Investments

The City’s authority to issue debt to finance capital investments such as infrastructure improvements, capital equipment essential to providing services, and community and economic development projects has a great impact on future generations of Bondurant citizens.

The community drives the initiatives through its executive elected officials, which consists of the Mayor and five Council Members and resident volunteer boards, commissions, and committees. The elected officials and resident volunteers collaborate with each other and City staff during regularly scheduled public meetings to create and shape comprehensive and visioning plans. It is these plans that drive the strategic goals for capital investment and prioritizes them. This policy guides and drives some of the considerations involved when deciding to use debt issuance and what type of debt to finance capital investments.

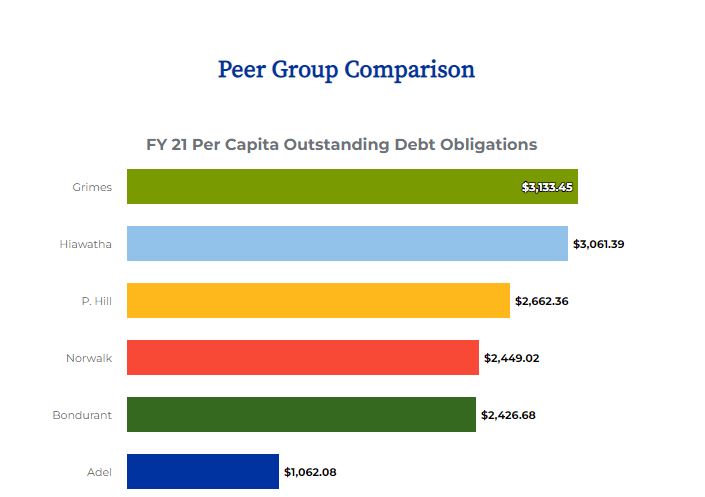

The City has established three benchmarks in regard to the issuance of debt. First, the City would like to limit the amount of general obligation debt issued to 80% of the constitutionally allowed limit. Secondly, the City would like bonded debt per capita not to exceed $3,800 for general obligation debt. Thirdly, the City will not borrow past the useful life of the improvement or equipment purchase but will borrow for the entire useful life of the improvement in an effort to ensure equity for end users and taxpayers. The City will be transparent in its borrowing, avoid balloon payment or variable rate debt, and continually monitor market conditions to take advantage of refinancing opportunities when possible.

The general obligation debt limit is set by the State of Iowa, and it stipulates that a City cannot exceed 5% of the value of taxable property in the city not incorporating the “roll-back”.

DEBT LIMITATION FOR GENERAL OBLIGATIONS as of June 30, 2021 |

|

| Amount |

|

| ||||

|

|

|

| Actual valuation--January 1, 2020 | $548,611,862 X 5% = $27,430,593 | ||||

As the general obligation debt is at $16,525,000 as of June 30, 2022, and the general obligation debt limit is at $27,430,593, the City was at 60% the legal debt limit.

Click Image to Enlarge.

The concept of this policy’s third part is based on the ideas of interperiod and generational equity. The Governmental Accounting Standards Board describes it as the state at which current-year taxpayers have provided the adequate resources to pay for the cost of current-year services and for their portion of the City’s assets they consume in relation to the assets’ useful life. It is the equilibrium in which the City neither passes on the costs of services and assets to the taxpayers of previous periods by deferral nor subsequent periods by accumulated assets. Generational Equity is the concept that users of a capital project or equipment will change over its useful life and the cost of those assets should be spread out to those that will use the capital investment over time. An example of passing costs to previous taxpayers is if the City saved cash reserves from tax receipts to the general fund over time to purchase playground equipment. In that scenario, it is likely not all the taxpayers that contributed to the cash reserves will benefit from the positive change in net position to the City’s assets, as often taxpayers move out of the City’s jurisdictions. Meaning those taxpayers that move away before the end of the assets' useful life will have contributed to the whole cost but did not get to use it to its maximum benefit. An example of passing costs to subsequent taxpayers using the previous example of purchasing playground equipment is, to acquire the equipment the City financed the purchase through general obligation bonds with a maturity term longer than the playground equipment’s useful life. In that scenario, the debt service payments would continue past the time for replacement of the equipment, resulting in taxpayers in subsequent years bearing the cost of debt service payment on equipment that no longer exists. One tool to achieve interperiod and generational equity for major capital expenditures is through strategic debt issuance. Selecting a financing option with even distributions of debt service payments and interest over the term of the bond by avoiding balloon payments and variable interest rates, while selecting a term that adequately aligns with the useful life of the capital investment is essential to achieving the City’s debt management goals. A comprehensive list of the outstanding obligations and the capital investment they financed can be found here.

The City uses professional services for bond financial advising, underwriting, and legal counsel to ensure that the City receives competitive bond sales, optimizes refinancing opportunities, and selects the appropriate type of bond for the capital investment, e.g. TIF revenue bond for TIF projects and utility revenue bonds for utility projects.