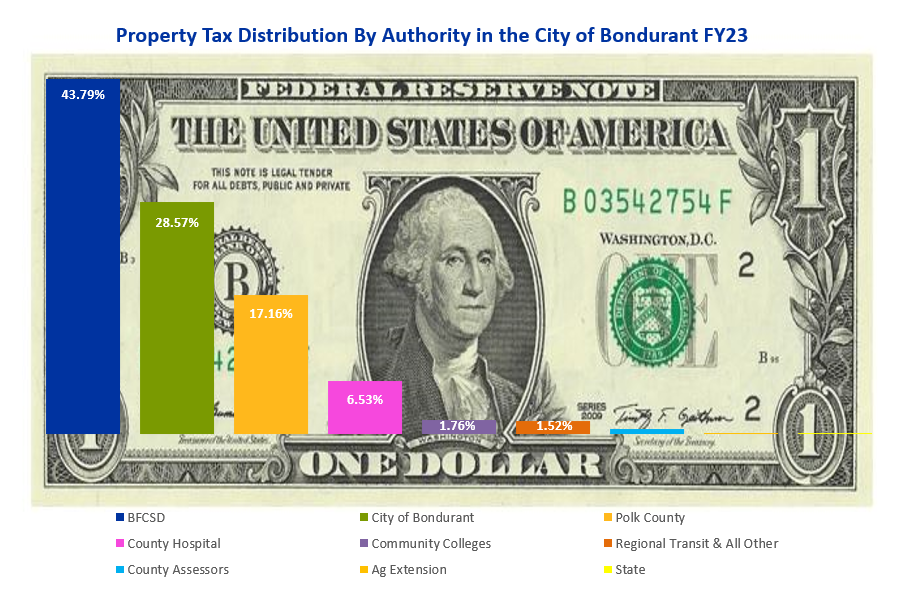

Property Tax Levy

Your annual property tax bill is made up of many tax rates, divided up among the Bondurant-Farrar School District, City of Bondurant, Polk County, Broadlawns Medical Center, Des Moines Area Community College, Des Moines RTA-Bondurant (DART), Polk County Assessor, Polk County Ag Extension, and the State of Iowa. Below is a graph showing the dispersal of property taxes. Please note the percentages change slightly each year and this graph is a general representation.

Click Image to Enlarge.

Now thanks to the Local Option Sales Tax that went into effect in January of 2020, the City of Bondurant – as promised – reduced its tax rate. By state law, 50 percent of the sales tax revenue must go toward property tax relief and Bondurant City Council chose to increase that amount to 60%. After receiving approval from voters, Bondurant City Council reduced the City’s property tax levy rate by $1.95. (Previously, the City had been working to lower its levy rate by $0.05 each year.)

Fiscal Year | City of Bondurant property tax levy rate |

| FY2017 | $ 13.88621 |

FY2018 | $ 13.83440 |

FY2019 | $ 13.78948 |

FY2020 | $ 13.73948 |

FY2021 | $ 11.78549 |

| FY22 | $ 11.62415 |

| FY23 | $ 11.27250 |

| FY24 | $ 11.26219 |

- Annual Budget Timeline

- Annual Reporting Compliance

- Capital Improvement Plan

- Finance Principles of Accounting

- Local Option Sales & Service Tax

- Funds/Budget Overview

Contact Information: Jené Nichelle Jess, SHRM-CP, Finance Director

• Phone: (515) 630-6981

• Email: jnjness@ciyofbondurant.com