The Role Your Assessed Value Plays in Determining Property Taxes

Memo published 3/6/2019 by the City of Bondurant.

During a regional presentation regarding property taxes, a representative from the Assessor’s office presented on the upcoming assessments. Assessments are updated every other year. New assessments notices will come out Friday, March 8th. Residential properties in Polk County have increased in value an average of 10%. This means when you see your notice of Assessed Valuation, you will likely see that it has increased.

Please note that an increase in your Assessed Valuation does not equate directly to an increase in property taxes paid. Property taxes are not determined by a single individual who assesses your property and sends you a bill. The final tax rate is the result of budgets established to provide services, an assessor’s assessment, a county auditor’s calculations, and laws administered by the Iowa Department of Revenue.

Following is an explanation of how property taxes are determined from the Iowa Department of Revenue:

1. The value of property is established.

The assessor (or the Iowa Department of Revenue) estimates the value of each property. This is called the "assessed value." The assessed value is to be at actual or market value for most property taxes.

2. The assessments of all taxable properties are added together.

The assessor totals the assessed value in each classification and reports it to the county auditor.

3. The Department examines total assessed values and equalizes them.

Each assessor sends the reports, called "abstracts," to the Iowa Department of Revenue. The abstract shows the total values of all real property in each jurisdiction by classification of property, not by individual property.

A process called "equalization" is applied every two years to ensure that property values are comparable among jurisdictions and complies with Iowa code. In addition, the "assessment limitation" is applied every year by the auditor. This process is commonly called "rollback" and is used in response to inflation. The application of the rollback results in taxable value in most cases.

The Iowa Department of Revenue is responsible for "equalizing" assessments every two years. A general explanation of the purpose of equalization follows:

The Department of Revenue compares the assessors’ abstracts to a "sales assessment ratio study" completed independently of the assessors. If the assessment (by property class) is 5% or more above or below the median ration of the sales ratio study, the Department of Revenue increases or decreases the assessment to reach 100% of actual value. There are no sales ratio studies for agricultural and industrial property.

Equalization occurs on an entire class of property, not on an individual property. Equalization is applied based on an assessing jurisdiction, not on a statewide basis.

Equalization helps maintain equitable assessments among classes of property and among assessing jurisdictions. This contributes to a more equitable distribution of state aid, including aid to schools. It also helps to equally distribute the total tax burden within the jurisdiction.

4. Budgets are established.

Each taxing authority determines its own budget. The budget includes the cost of providing services, the amount of aid received from the federal and state governments, the amount of money remaining from previous years, and revenue from other charges for services. Each approved budget is submitted to the county auditor.

5. A tax rate is established.

The county auditor divides the amount of the budget that is not funded by other sources by the taxable value of all the property in the taxing district.

The result is referred to as "dollars per thousand." For example, if the dollars per thousand were $10, the tax on a home valued at $50,000 would be calculated at $10 x 50. The tax on that home would be $500 for that single taxing authority.

The rates for all authorities are added together, resulting in a single tax levy called a consolidated levy for each unique set of taxing districts. The consolidated levy rate is always the result of two or more tax rates established by different government entities.

6. Credits are subtracted.

Credits such as the Homestead Credit are subtracted before a final tax bill is sent to the taxpayer.

Equalization and Rollbacks

Before you ever see your tax bill, two additional steps occur to test and adjust assessments to legal levels.

Equalization

In Step 3 above, the Iowa Department of Revenue is responsible for "equalizing" assessments every two years. A general explanation of the purpose of equalization follows:

The Department of Revenue compares the assessors’ abstracts to a "sales assessment ratio study" completed independently of the assessors. If the assessment (by property class) is 5% or more above or below the median ration of the sales ratio study, the Department of Revenue increases or decreases the assessment to reach 100% of actual value. There are no sales ratio studies for agricultural and industrial property.

Equalization occurs on an entire class of property, not on an individual property. Equalization is applied based on an assessing jurisdiction, not on a statewide basis.

Equalization helps maintain equitable assessments among classes of property and among assessing jurisdictions. This contributes to a more equitable distribution of state aid, including aid to schools. It also helps to equally distribute the total tax burden within the jurisdiction.

Rollbacks

More than 20 years ago, residential property values were rising quickly. To help cushion the impact of high inflation, the Legislature passed an assessment limitation law called rollback.

Increases in assessed values for residential and agricultural property are subject to this assessment limitation formula. If the statewide increase in values of homes and farms exceeds 3% due to revaluation, their values are "rolled back" so that the total increase in aggregate value statewide is 3%.

Rollback for agricultural and residential property is allowed to fluctuate within the 3% limitation. This does not mean that the assessment on your home will increase by only 3%. The rollback is applied on a class of property, not an individual property. It means that the statewide total taxable value can increase by only 3% due to revaluation.

Based on current indicators, the rollback is expected to go down approximately 4% next year, meaning a reduction in the Taxable Value of an individual, residential property owner.

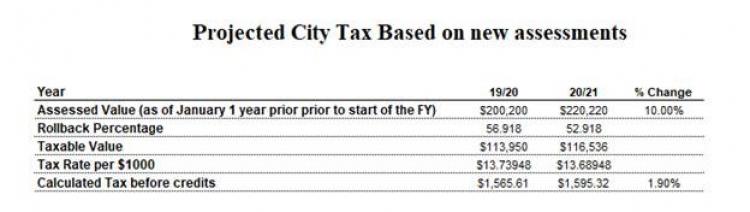

Following is a table to illustrate how the assessment translates into property taxes. For the current fiscal year, the average Assessed Value for a home in Bondurant is $200,200; the current rollback percentage is 56.918, and the current City levy rate is $13.73948. The City has been lowering the tax rate by $0.5 for the past 13 years and anticipates doing so again. Combining all of these factors, the table illustrates what property tax amount would be anticipated. As you can see, while the Assessed Value increases by 10%, the amount of Calculated Tax changes by only 1.9%.

If you have any questions about your City property taxes or the City budget, please do not hesitate to contact the City Administrator or for a full copy of the City’s budget, please click here.

Additional information about property tax calculation is available here.